Tags

Financial Systemic Issues: Booms and Busts - Central Banking and Money - Corporate Governance - Cryptocurrencies - Government and Bureaucracy - Inflation - Long-term Economics - Risk and Uncertainty - Retirement Finance

Financial Markets: Banking - Banking Politics - Housing Finance - Municipal Finance - Sovereign Debt - Student Loans

Categories

Blogs - Books - Op-eds - Letters to the editor - Policy papers and research - Testimony to Congress - Podcasts - Event videos - Media quotes - Poetry

Negative real interest rates are politics

Published by the R Street Institute.

In a recent Wall Street Journal piece, Jason Zweig cites Harvard’s Carmen Reinhart as rightly pointing out that “low interest rates will keep transferring massive amounts of wealth from savers to borrowers.” In fact, short-term interest rates are not merely “low,” but in real, inflation-adjusted terms, they are negative.

The negative real interest rates imposed by the Federal Reserve for more than seven years now have, indeed, expropriated savings and subsidized borrowings. In particular, they have subsidized leveraged speculation, providing essentially free margin loans to the speculators at the expense of the savers. As a temporary crisis measure in a financial panic, one can defend this. But not for more than seven years.

A cynical description of politics is taking money from the public and giving it to your friends. In simple fact, when you use the power of the government to take money from some people and give it to others, that is absolutely politics, no matter what else it might also be called. For example, it might also be called “monetary policy.” By imposing negative real interest rates, the Fed is without question engaging in political decisions and political actions.

The average real yield on six-month Treasury bills since the end of 2008 has been negative 1.3 percent. The 50-year historical average is about positive 1.6 percent. The difference goes right out of the pockets of the savers and into the pockets of borrowers. Of course, the biggest borrower of all, which gets by far the biggest transfer of money, is the federal government itself. In this sense, negative interest rates are another way of imposing a tax. Imposing a tax is obviously a political act.

Where does the Fed get the legitimacy to impose taxes and to take some people’s money and give it to others, for years after the crisis has ended? How and to whom is it accountable for these political acts?

Where, how and to whom, indeed?

Housing Finance: Two strikes, and now?

Published in the Urban Institute.

Memories fade. So while trying to draw conclusions about going forward, we should also do our best to remember our past expensive lessons in politicized housing finance.

It should be most sobering to Americans engaged in mortgage lending that the U.S. housing-finance sector collapsed twice in three decades—a pretty dismal record. There was first the collapse of the savings and loan-based system in the 1980s, then again that of the Fannie Mae and Freddie Mac-based system in the 2000s. The first also caused the failure of the government’s Federal Savings and Loan Insurance Corp.; the second forced the government to admit that the U.S. Treasury really was on the hook for the massive debt of Fannie and Freddie, frequent protestations to the contrary notwithstanding. The first generated a taxpayer bailout of $150 billion; the second, a taxpayer bailout of $187 billion. That’s two strikes. Are we naturally incompetent at housing finance?

In both cases, the principal housing-finance actors had tight political ties to the government, which allowed them to run up risk while claiming a sacred housing mission. The old U.S. League for Savings, the trade association for savings and loans, was in its day a serious political force and closely linked with the Federal Home Loan Bank Board. In their glory days, in turn, Fannie and Freddie bestrode the Washington and housing worlds like a hyper-leveraged colossus. In retrospect, these were warning signs.

The savings and loans did what the regulators told them to do: make long-term, fixed-rate mortgage loans financed short. Fannie and Freddie were viewed as a solution to this interest-rate-risk problem, then had a credit-risk disaster instead. They, too, did what the regulators told them to do: acquire a lot of lower-credit-quality loans. Thinking that regulators know what risks will come home to roost in the future is another warning sign.

We need to eschew all politicized schemes and move to something more like a real housing-finance market, if we want to avoid strike three.

Pollock testifies on CHOICE Act before House Financial Services

Published by the R Street Institute.

R Street Distinguished Senior Fellow Alex J. Pollock testified July 12, 2016 before the House Financial Services Committee about the CHOICE Act, legislation that proposes to loosen regulatory controls on banks that choose to hold sufficient capital to offset their risk to the financial system. Video of Alex’s testimony, as well as Q&A about the Volcker Rules and other reforms to the Dodd-Frank Act, is embedded below.

Seven steps to housing-finance reform

Published by the R Street Institute.

The attached policy brief appeared in the Housing Finance Reform Incubator report published in July 2016 by the Urban Institute.

The giant American housing finance sector is as important politically as it is financially, which makes it hard to reform. From the 1980s on, it was unique in the world for its overreliance on the “government-sponsored enterprises” (GSEs), Fannie Mae and Freddie Mac—privately owned, but privileged and with “implicit” government guarantees. According to Fannie and Freddie, their lobbyists and members of Congress reading scripts from Fannie in its former days of power and glory, this made American housing finance “the envy of the world.”

In fact, it didn’t, and the rest of the world did not experience such envy. But Fannie and Freddie did attract investment from the rest of the world, which correctly saw them as U.S. government credit with a higher yield: this channeled the savings of thrifty Chinese and others into helping inflate American house prices into their historic bubble. Fannie and Freddie were a highly concentrated point of systemic vulnerability.

Needless to say, Fannie and Freddie, and American housing finance in general, then became “the scandal of the world” as they went broke. What schadenfreude my German housing-finance colleagues enjoyed after years of being lectured by the GSEs on the superiority of the American system. Official bodies in the rest of the world pressured the U.S. Treasury to protect their investments in the insolvent Fannie and Freddie, which of course it did and does. The Treasury is also protecting the Federal Reserve, which in the meantime became the world’s biggest investor in Fannie and Freddie securities.

More than seven years later, America is still unique in the world for centering its housing-finance sector on Fannie and Freddie, even though they have equity capital that rounds to zero. Now they are primarily government-owned and entirely government-controlled housing-finance operations, completely dependent on the taxpayers. Nobody likes this situation, but it has already outlasted numerous reform proposals.

Is there a way out that looks more like a market and less like a statist scheme? A way that reduces the distortions of excessive credit that inflates house prices, runs up leverage and sets up both borrowers and lenders for failure? In other words, can we reduce of the chance of repeating the mistakes of 1980 to 2006? I suggest seven steps to reform American housing finance:

Turn Fannie and Freddie into SIFIs at the “10 percent moment”

Enforce the law on Fannie and Freddie’s guarantee fees

Encourage skin in the game from mortgage originators

Form a new joint FHLB mortgage subsidiary

Create countercyclical LTVs

Reconsider local mutual self-help mortgage lenders

Liquidate the Fed’s MBS portfolio

Turn Fannie and Freddie into SIFIs at the ’10 percent moment’

The original bailout deal for Fannie and Freddie created a senior preferred stock with a 10 percent dividend. As everybody knows, the amended deal makes all their net profit a dividend, which means there will never be any reduction of the principal, no matter how much cash Fannie and Freddie send the Treasury. It is easy, however, to calculate the cash-on-cash internal rate of return (IRR) to the Treasury on its $189.5 billion of senior preferred stock. So far, this is about 7 percent – positive, but short of the required 10 percent. But as Fannie and Freddie keep sending cash to the Treasury, the IRR will rise and will reach a point when total cash paid is equivalent to a 10 percent compound return, plus repayment of the entire principal. That is what I call the “10 percent moment.” It provides a uniquely logical point for reform, and it is not far off, perhaps late 2017 or early 2018.

At the 10 percent moment, whenever it arrives, Congress should declare the senior preferred stock fully repaid and retired, as in financial substance it will have been. Simultaneously, Congress should formally designate Fannie and Freddie as Systemically Important Financial Institutions (SIFIs). That they are indeed SIFIs – able to put not only the entire financial system but also the finances of the U.S. government at risk – is beyond the slightest doubt.

As soon as Fannie and Freddie are officially, as well as in economic fact, SIFIs, they will get the same minimum capital requirement as bank SIFIs: 5 percent of total assets. At their current size, this would require about $250 billion in equity. This is a long trip from zero, but they could start building capital, while of course being regulated as undercapitalized until they aren’t. Among other things, this means no dividends on any class of stock until the capital requirement is met.

As SIFIs, Fannie and Freddie will get the Fed as their systemic risk regulator. In general, they should be treated just like big bank SIFIs. Just as national banks have the Fed, as well as the Comptroller of the Currency, they will have the Fed, as well as the Federal Housing Finance Agency.

Since it is impossible to take away Fannie and Freddie’s too-big-to-fail status, they should pay the government for its ongoing credit guaranty, just as banks pay for theirs. I recommend a fee of 0.15 percent of total liabilities per year.

Fannie and Freddie will be able to compete in mortgage finance on a level basis with other SIFIs, and swim or sink according to their competence.

Enforce the law on Fannie and Freddie’s guarantee fees

In the Temporary Payroll Tax Cut Continuation Act of 2011, Title IV, Section 401, “Guarantee Fees,” Congress has already decided how Fannie and Freddie’s guarantee fees (g-fees) must be set. Remarkably, the law is not being obeyed by their conservator, the Federal Housing Finance Agency.

The text of the statute says the guarantee fees must “appropriately reflect the risk of loss, as well the cost of capital allocated to similar assets held by other fully private regulated financial institutions.”

This is unambiguous. The simple instruction is that Fannie and Freddie’s g-fees must be set to reflect the capital that private banks would have to hold against the same risk, and also the return private banks would have to earn on that capital. The economic logic is clear: to get private capital into the secondary mortgage market, make Fannie and Freddie price to where private financial institutions can fairly compete.

This is, in fact, a “private sector adjustment factor,” just as the Fed must use for its priced services. The difference is that the Fed obeys the law and the FHFA doesn’t.

Of course, the FHFA finds this legislative instruction highly inconvenient politically, so ignores it or dances around it. But Congress didn’t write the act to ask the FHFA what it liked, but to tell it what to do. The FHFA needs to do it.

Encourage skin in the game for mortgage originators

A universally agreed-upon lesson from the American housing bubble was the need for more “skin in the game” of credit risk by those involved in mortgage securitization. But lost in most of the discussion was the optimal point at which to apply credit-risk skin in the game. This point is the originator of the mortgage loan, which should have a junior credit risk position for the life of the loan. The entity making the original mortgage is in the best position to know the most about the borrower and the credit risk of the borrower. It is the most important point at which to align incentives for creating sound credits.

The Mortgage Partnership Finance (MPF) program of the Federal Home Loan Banks was and is based on this principle. (I had the pleasure of leading the creation of this program.) The result was excellent credit performance of the MPF mortgage loans, including through the crisis. The principle is so obvious, isn’t it?

I do not suggest making this a requirement for all originators, but to design rules and structures in mortgage finance to encourage this optimal credit strategy.

Form a new joint FHLB mortgage subsidiary

Freddie Mac was originally a wholly owned, joint subsidiary of the 12 Federal Home Loan Banks (FHLBs). Things might have turned out better if it had remained that way.

FHLBs (there are now 11 of them) are admirably placed to operate secondary markets with the thousands of smaller banks, thrifts and credit unions—and perhaps others—that originate mortgages in their local markets. As lenders to these institutions, FHLBs know and have strong ability to enforce the obligations of the originators, both as credit enhancers and as servicers. But to be competitive, and for geographic diversification, they need a nationwide scope.

The precedent for the FHLBs to form a nationally operating mortgage subsidiary is plain. They should do it again.

Create countercyclical LTVs

As the famous investor Benjamin Graham pointed out long ago, price and value are not the same: “Price is what you pay, and value is what you get.”

Likewise, in mortgage finance, the price of the house being financed is not the same as its value, and in bubbles, prices greatly exceed the sustainable value of the house. Whenever house prices are in a boom, the ratio of the loan to the sound lendable value becomes something much bigger than the ratio of the loan to the inflated current price.

As the price of any asset, including houses, goes rapidly higher and further over its trend line, the riskiness of the future price behavior becomes greater—the probability that the price will fall a lot keeps increasing. Just when lenders and borrowers are feeling more confident because of high collateral “values” (really, prices), their danger is, in fact, growing. Just when they are most tempted to lend and borrow more against the price of the asset, they should be lending and borrowing less.

A countercyclical LTV (loan-to-value ratio) regime would reduce the maximum loan size relative to current prices, in order to keep the maximum ratio of loan size to underlying lendable value more stable. The boom would thus induce smaller LTPs (loan-to-price ratios); steadier LTVs; and greater down payments in bubbly markets—thus providing an automatic dampening of price inflation and a financial stabilizer.

Often discussed are countercyclical capital requirements for financial institutions, which reduce the leverage of those lending against riskier prices. The same logic applies to reducing the leverage of those who are borrowing against risky prices. We should do both.

Canada provides an interesting example of where countercyclical LTVs have actually been used.

Reconsider local mutual self-help mortgage lenders

In the long-forgotten history of mortgage lending, an important source of mortgage loans were small, mutual associations owned by their depositors and operating with an ethic that stressed saving, self-discipline, self-help, mutual support and homeownership. Demonstrated savings behavior and character were key qualifications for borrowing. The idea of a mortgage was to pay it off.

In the Chicago of 1933, for example, the names of such associations included: Amerikan, Archer Avenue, Copernicus, First Croatian, Good Shepherd, Jugoslav, Kalifornie, Kosciuszko, Narodi, Novy Krok, Polonia, St. Paul, St. Wenceslaus, Slovak and Zlata Hora…you get the idea.

In my opinion, the ideals of these mutual associations are worth remembering and reconsidering; they might be encouraged (not required) again. We would have to make sure that current loads of regulatory compliance costs are not allowed to smother any such efforts at birth.

Liquidate the Fed’s MBS portfolio

What is the Fed, a central bank, doing holding $1.7 trillion of mortgage-backed securities (MBS)? The founders of the Fed and generations of Fed officers since would have found that impossible to imagine. The MBS portfolio exists because the Fed was actively engaged in pushing up house prices, as part of its general scheme to create “wealth effects,” by allocating credit to the housing sector using its own balance sheet. It succeeded— house prices have not only risen rapidly, but are back over their trend line on a national average basis.

Why is the Fed still holding all these mortgages? For one thing, it doesn’t want to recognize losses when selling its vastly outsized position would drive the market against it. Some economists argue that even big losses do not matter if you are a fiat currency central bank. Perhaps not, but they would be embarrassing and unseemly.

Whatever justification there may have been in the wake of the collapsed housing bubble, the Fed should now get out of the business of manipulating the mortgage market. It can avoid recognizing any losses by simply letting its mortgage portfolio steadily run off to zero over time through maturities and prepayments. It should do so, and cease acting as the world’s biggest savings and loan.

Especially with the reforms to Fannie and Freddie discussed above, we would get closer to having a market price of mortgage credit. Imagine that!

Envoi

Will these seven steps solve all the problems of American mortgage finance and ensure that we will never have another crisis? Of course not. But they will set us on a more promising road than sitting unhappily where we are at present.

Testimony to House Financial Services Committee on the CHOICE Act

Published by the R Street Institute.

Mr. Chairman, Ranking Member Waters and members of the committee, thank you for the opportunity to be here today. I am Alex Pollock, a senior fellow at the R Street Institute, and these are my personal views. I spent 35 years in banking, including 12 years as president and CEO of the Federal Home Loan Bank of Chicago and then 11 years as a fellow of the American Enterprise Institute, before joining R Street earlier this year. I have both experienced and studied many financial cycles, including the political contributions and reactions to them, and my work includes the issues of banking systems, central banking, risk and uncertainty in finance, housing finance and government-sponsored enterprises and the study of financial history.

“Detailed intrusive regulation is doomed to fail.” This is the considered and, in my view, correct conclusion of a prominent expert in bank regulation, Sir Howard Davies, former chairman of the U.K. Financial Services Authority and former director of the London School of Economics. Detailed, intrusive regulation is what we’ve got, and under the Dodd-Frank Act, ever more of it. “Financial markets cannot be directly ‘controlled’ by public authorities except at unsustainable cost,” Davies adds. Surely there is a better way to proceed than promoting unfettered bureaucratic agencies trying through onerous regulation to do something at which they are doomed to fail.

I believe the CHOICE Act offers the opportunity of a better way, precisely by offering banks a fundamental choice.

The lack of sufficient capital in banks is a permanent and irresistible temptation to governments to pursue intrusive microregulation, which becomes micromanagement. This has an underlying logic to it. In a world in which governments explicitly and implicitly guarantee bank creditors, the government in effect is supplying risk capital to the banks which do not have enough of their own. Suppose the real requirement in a true market would be for an equity capital ratio of 8 percent of assets, but the bank has only 4 percent. The government implicitly provides the other 4 percent – or half the required capital. We should not be surprised when the, in effect, 50 percent shareholder demands a significant say about how the bank is run, even if the resulting detailed regulations will not be successful.

However, the greater the equity capital is, the less rationale there is for the detailed regulation. In our example, if the bank’s own capital were 8 percent, the government’s effective equity stake would be down to zero. This suggests a fundamental and sensible trade-off: more capital, reduced intrusive regulation. But want to run with less capital? You get the intrusive regulation.

In other words, the CHOICE Act says to U.S. banks: “You don’t like the endless additional regulation imposed on you by the bloated Dodd-Frank Act. Well, get your equity capital up high enough and you can purge yourself of a lot of the regulatory burden, deadweight cost and bureaucrats’ power grabs which were all called forth by Dodd-Frank.”

CHOICE does not set up higher capital as a mandate or an order to increase the bank’s capital. Rather it offers a very logical decision to make between two options. These are:

Option One: Put enough of your equity investors’ own money in between your creditors and the risk that other people will have to bail the creditors out if you make mistakes. Mistakes are inevitable when dealing with the future, by bankers, regulators, central bankers and everybody else. The defense is equity capital; have enough so that the government cannot claim you are living on the taxpayers’ credit, and therefore cannot justify its inherent urge to micromanage.

Option Two: Don’t get your equity capital up high enough and instead live with the luxuriant regulation of Dodd-Frank. This regulation is the imposed cost of, in effect, using the taxpayers’ capital instead of your own to support your risks.

I believe the choice thus offered in the proposed act is a truly good idea. To my surprise, The Washington Post editorial board agrees. They write:

More promising, and more creative, is Mr. Hensarling’s plan to offer relief from some of Dodd-Frank’s more onerous oversight provisions to banks that hold at least 10 percent capital as a buffer against losses…such a [capital] cushion can offer as much—or more—protection against financial instability as intrusive regulations do, and do so more simply.

Very true and very well-stated.

Making the choice, banks would have to consider their cost of capital versus the explicit costs and opportunity costs of the regulatory burden. Some might conclude that Option Two would yield higher returns on equity than Option One; some will conclude that Option One is the road to success. I imagine some banks would choose one option, while some would choose the other.

Different choices would create a healthy diversification in the banking sector. They would also create, over time, a highly useful learning experience for both bankers and governments. One group would prove to be sounder and to make greater contributions to economic growth and innovation. One group would, in time, prosper more than the other. The other group will end up less sound and less successful. Which would be which? I think the group with more capital, operating in relatively freer markets with greater market discipline, would prove more successful. But we would find out. Future think-tank fellows could write highly instructive papers on the contrast.

Of course, to establish the proposed choice, we have to answer the question: how much capital makes is high enough? For a bank to make the deal proposed in the CHOICE Act, it would have to have a tangible leverage capital ratio of at least 10 percent. That is a lot more than current requirements, but is it enough?

Consider the matter first in principle: without doubt there is some level of equity capital at which this trade-off makes sense—some level of capital at which everyone, even habitual lovers of bureaucracy, would agree that the Dodd-Frank burdens become superfluous or, at least, cause costs far in excess of their benefits.

What capital ratio is exactly right can be, and is, disputed. Because government guarantees, subsidies, mandates and interventions are so intertwined with today’s banks, there is simply no market answer available. Moreover, we are not looking for a capital level which would remove all regulation—only the notorious overreaction and overreach of Dodd-Frank. For example, the CHOICE Act requires to qualify for Option One that, in addition to 10 percent tangible capital, a bank must have one of the best two CAMELS ratings by the regulator—”CAMELS” being assessments of capital, asset quality, management, earnings, liquidity and sensitivity to market risk.

Numerous proposals for the right capital levels have been made. However, the fact that no one knows the exact answer should not stop us from moving in the right direction.

Among various theories and studies, the International Monetary Fund concluded that “bank [risk-based] capital in the 15-23 percent range would have avoided creditor losses in the vast majority of past banking crises,” and that this range is consistent with “9.5 percent of total leverage exposure.” Obviously, a 10 percent level is somewhat more conservative than that.

Economist William Cline recently concluded that “the optimal ratio for tangible common equity is about 6.6 percent of total assets and a conservative estimate…is about 7.9 percent.”

Paul Krugman proposed a maximum assets-to-capital ratio of 15:1, which is equivalent to a leverage capital ratio of 6.7 percent. Anat Admati and Martin Hellwig came in much higher, arguing for a leverage capital requirement of 20 percent to 30 percent – however, with no empirical analysis. Economists David Miles, Jing Yang and Gilberto Marcheggiano estimated optimal bank capital at about 20 percent of risk-weighted assets, which in their view means a 7 percent to 10 percent leverage capital ratio.

In a letter to the Financial Times, a group of academics asserted a requirement for 15 percent leverage capital, but a study by economists Anil Kashyap, Samuel Hanson and Jeremy Stein proposed risk-based capital of 12 percent to 15 percent, which means a leverage capital ratio of 6 percent to 8 percent. Banking expert Charles Calomiris proposed 10 percent leverage capital.

All in all, it seems to me that the 10 percent tangible leverage capital proposed in the CHOICE Act to qualify for Option One is a fair level. It subtracts all intangible assets and deferred-tax assets from the numerator of the ratio, and adds the balance sheet equivalents of off-balance sheet items to the total assets in the denominator. Thus, it is a conservatively structured measure.

In 2012, Robert Jenkins, then a member of the Bank of England’s Financial Policy Committee, gave a speech to the Worshipful Company of Actuaries entitled “Let’s Make a Deal,” which put forward the same fundamental idea as does the CHOICE Act. The proposed deal was a “rollback of the rule book” in exchange for banks raising “their tangible equity capital to 20 percent of assets.” He explained the logic as follows:

“We all agree that too many bankers got it wrong.”

“We acknowledge that too many regulators got it wrong.”

So, the best solution is to increase the tangible equity and “in return we can pare back the rule book—drastically.”

Under the CHOICE Act, in exchange for 10 percent tangible leverage capital, along with a high CAMELS rating, the deal is, to repeat, not to eliminate all regulation, but to exit from the excesses of Dodd-Frank. We should view Dodd-Frank in its historical context, as an expected political overreaction to the then-recent crisis. Now, for banks taking Option One, there would still be plenty of regulation, but not the notoriously onerous entanglements of Dodd-Frank. In exchange for Jenkins’ suggested move to 20 percent leverage capital, one would rationally eliminate a lot more regulation and bureaucratic power—to pare it back, as he says, “drastically.” The proposed act is more moderate.

The CHOICE Act uses the simple and direct measure of tangible leverage capital. This is, in my judgment, superior to the complex and sometimes opaque measures of risk-adjusted assets and risk-based capital. Although, in theory, risk-based capital might have been attractive, in fact, its manifestations have been inadequate, to say the least. Risk adjustments assume a knowledge in regulatory bureaucracies about what is more or less risky that does not exist—because risk is in the future. They are subject to manipulations and mistakes and, more importantly, to political factors. Thus, for example, Greek sovereign debt was given a zero risk weighting and ended up paying lenders 25 cents on the dollar. The risk weightings of subprime MBS are notorious. Fannie Mae and Freddie Mac debt and preferred stock were given preferential risk weightings, which helped inflate the housing bubble—a heavily political decision and a blunder.

The deepest problem with risk weightings is that they are bureaucratic, while risk is dynamic and changing. Designating an asset as low risk is likely to induce flows of increased credit, which end up making it high risk. What was once a good idea becomes a “crowded trade.” What was once a tail risk becomes instead a highly probable unhappy outcome.

Of course, no single measure tells us all the answers. Of course, managing a bank or supervising a bank entails understanding multiple interacting factors. But for purposes of setting up the choice for banks in the proposed act, I believe the simplicity of tangible leverage capital is the right answer.

In my judgment, the proposed choice between Option One and Option Two makes perfect sense. It takes us in the right direction and ought to be enacted.

Thank you again for the chance to share these views.

Mismatch has led us into trouble many times before

Published in the Financial Times.

Financial events cycle and financial ideas cycle. Here the United Kingdom is again, with real estate generating financial stress. As Patrick Jenkins rightly points out (“Open-ended property funds are accidents waiting to happen,” July 6), this vividly displays “the fundamental mismatch between a highly illiquid asset class and a promise of instant access to your money.”

This same mismatch has led us into trouble many times before. It is why the original U.S. National Banking Act of 1864 prohibited the national banks, as issuers of deposits and currency payable on demand, from making any real estate loans at all. “The property market is already too volatile,” says Mr. Jenkins. Yes, and it always has been.

In tracking homeownership, marriage matters

Published in Real Clear Policy with Jay Brinkmann.

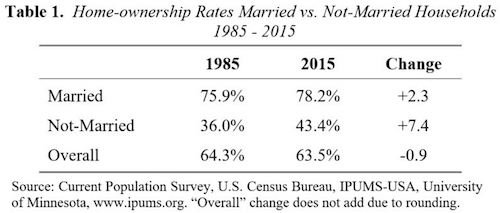

Homeownership long has been considered a key metric for economic well-being in the United States. Thus, many are dismayed by the fact that, at 63.5 percent, the 2015 overall homeownership rate appears to be lower than the 64.3 percent of 1985, a generation ago. But viewed in another, arguably more relevant way, the underlying trend shows the homeownership rate is, in fact, increasing, not decreasing.

How so? Key to the trend is the extremely strong relationship between marriage and homeownership — a relationship seldom, if ever, addressed in housing-finance discussions. But if you think about it, it’s obvious that homeownership should be higher among married couples than among other households; in fact, it’s remarkably higher.

This relationship holds across all demographic groups. Importantly, it means that changes in the proportion of married versus not-married households is a major driver of changes in the overall homeownership rate over time. Homeownership comparisons among demographic groups are similarly influenced by differences in their respective proportions of married versus not-married households.

Policy discussions over falling homeownership rates frequently ignore some critical underlying demographic facts.

The current 63.5 percent American homeownership rate combines two very different components: married households, with about 78 percent homeownership, and not-married households, with only 43 percent homeownership. Married households have a homeownership rate 1.8 times higher — obviously a big difference. (As we have organized the data, these two categories comprise all households: “married” means married with spouses present or widowed; “Not-married” means never married, divorced, separated or spouse absent.)

Table 1 contrasts homeownership by married versus not-married households, showing how these homeownership rates have changed since 1985.

One is immediately struck by a seeming paradox:

The homeownership rate for married households has gone up by 2.3 percentage points.

The homeownership rate for not-married households has gone up even more, by 7.4 percentage points.

But the overall homeownership rate has gone down.

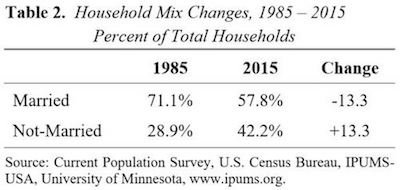

How is this possible? The answer is that the overall homeownership rate has fallen because the percentage of not-married households has dramatically increased over these three decades. Correspondingly, married households (which have a higher homeownership rate) are now a smaller proportion of the total. Still, homeownership rose for both component parts. So the analysis of the two parts gives a truer picture of the underlying rising trend.

The dramatic shift in household mix is shown in Table 2.

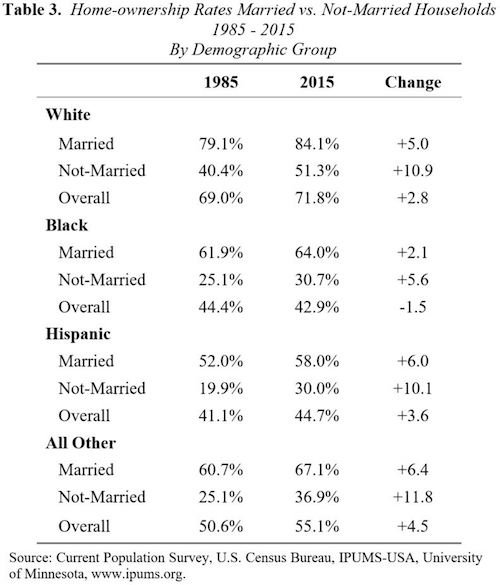

Table 3 shows that the strong contrast between married and not-married homeownership rates and related changes from 1985-2015 hold for each demographic group we examined.

That is, homeownership for both married and not-married households went up significantly for all four demographic groups from 1985 to 2015.

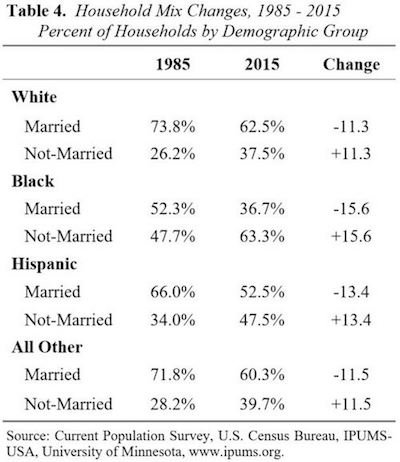

Moreover, overall homeownership also increased for three of these four groups. Homeownership for black households, meanwhile, fell by 1.5 percentage points, though homeownership for both married and not-married components rose for this demographic as well. (This is consistent with that group’s showing the biggest shift from married to not-married households.)

In another seeming paradox, Hispanic homeownership rates rose, while still contributing to a reduction in the overall U.S. rate. The reason for this is that their share of the population more than doubled, increasing the weight of their relatively high share of not-married households.

The trends by group in the mix of married versus not-married households are shown in Table 4.

What would the U.S. homeownership rate be if the proportions of married and not-married households were the same as in 1985? Applying the 2015 homeownership rates for married and not-married households to the mix that existed in 1985 results in a pro forma U.S. homeownership rate of 68.1 percent. This would be significantly greater than both the 1985 level of 64.3 percent and the 2015 measured level of 63.5 percent.

Adjusting for the changing mix of married versus not-married households gives policymakers a better understanding of the underlying trends. This improved understanding is particularly important when weaker credit standards are proposed as a government solution to the lower overall homeownership rate.

To make sense of homeownership rates, we have to consider changes in the mix of married versus not-married households. And these changes have been dramatic over the last 30 years.

The perfect antidote to Dodd-Frank

Published in American Banker.

To overhaul the Dodd-Frank Act, here is a radical and really good idea from House Financial Services Committee Chairman Jeb Hensarling, R-Texas.

The Financial CHOICE Act, Hensarling’s bill, says to U.S. banks: “Don’t like the endless additional regulation imposed on you by the bloated Dodd-Frank Act? Get your equity capital up high enough and you can purge yourself of a lot of the regulatory burden, deadweight cost and bureaucrats’ power grabs – all of which Dodd-Frank called forth.”

This Choice bill, which stands for Creating Hope and Opportunity for Investors, Consumers and Entrepreneurs, is not an order to increase your capital. Rather, it’s offering a logical choice.

Option 1: Put enough of your equity investors’ own money in between your creditors and the risk that other people will have to bail them out if you make big mistakes. And you may. Then, the government can’t claim you live on the taxpayers’ credit, and therefore, can’t justify its inherent urge to micromanage.

Option 2: Don’t get your equity capital up high enough and live with the luxuriant regulation instead. Think of this scenario as the imposed cost of using the taxpayers’ capital instead of your own to support your risks.

Depending on how large the explicit costs and the opportunity costs of the regulation are, you might think that the second option will yield higher returns on equity than option one or you might not. Some banks would choose one option, while some would choose the other.

Different choices would create diversification in the banking sector. They would also create highly useful learning over time. One group would end up sounder and make greater contributions to economic growth and innovation. One group would, over time, prosper more than the other.

Of course, we have to answer: how high is high enough? The 10 percent tangible leverage capital required to get the deal in the proposed legislation is a lot more than now, but is it even enough?

To consider the matter first in principle: surely, there is some level of equity capital at which this trade-off makes sense, some level at which everyone — even habitual lovers of bureaucracy — would agree that the Dodd-Frank burdens would be superfluous, or at least, cause costs far in excess of their benefits.

What capital ratio is exactly right can be, and is, disputed. Because government guarantees, mandates and interventions are so intertwined with today’s banks, there is simply no market answer available. Numerous proposals, based on more or less no data, have been made. The fact that no one knows the exact answer should not, however, stop us from moving in the right direction.

Among various theories, economist and New York Times columnist Paul Krugman proposed a maximum assets-to-capital ratio of 15:1, which means a minimum leverage capital ratio of 6.7 percent. Anat Admati, a Stanford finance professor, and Martin Hellwig, an economics professor at the University of Bonn, argued for a 20 percent to 30 percent leverage capital requirement with no empirical analysis. Economists David Miles, Jing Yang and Gilberto Marcheggiano estimated that the optimal bank capital is about 20 percent of risk-weighted assets, which in their view means 7 percent to 10 percent leverage capital, in a white paper. A group of 20 academics from finance and banking specializations suggested in a letter to the Financial Times a 15 percent leverage capital requirement. Economists Anil Kashyap, Samuel Hanson and Jeremy Stein proposed 12 percent to 15 percent risk-weighted, which means about 6 percent to 8 percent leverage capital. Professor Charles Calomiris suggested 10 percent leverage capital. Economist William Cline estimated the optimal leverage capital ratio at 6.6 percent to 7.9 percent. Robert Jenkins, a member of the financial policy committee at the Bank of England, gave a speech to the Worshipful Company of Actuaries entitled “Let’s Make a Deal,” where the deal was the “rollback of the rule book” in exchange for raising “equity capital to 20 percent of assets.” In my opinion, the 10 percent tangible leverage capital ratio in Hensarling’s bill is a fair stab at it.

In exchange for 10 percent leverage capital, it is essential to understand that the deal is not to eliminate all regulation. Indeed, there would still be plenty of regulation for banks taking the deal. However, option one is a distinctly better choice than the notorious overreaction and overreach of Dodd-Frank. In exchange for a further move to 20 percent leverage capital, one would rationally eliminate a lot more regulation and bureaucratic power.

It’s also essential to understand that the proposed capital ratio as specified in the Hensarling bill subtracts all intangible assets and deferred-tax assets from the allowable capital and adds the balance sheet equivalents of off-balance sheet items to total assets. Thus, it is conservative in both the numerator and denominator of the ratio.

In my judgment, the choice offered to banks by Chairman Hensarling’s proposal makes perfect sense. It goes in the right direction and ought to be enacted. Even the Washington Post editorial board agrees with this. In an op-ed, the editorial board writes:

More promising, and more creative is Mr. Hensarling’s plan to offer relief from some of Dodd-Frank’s more onerous oversight provisions to banks that hold at least 10 percent capital as a buffer against losses…such a cash cushion can offer as much—or more—protection against financial instability as intrusive regulations do, and do so more simply.

Very true!

Why can’t the US reform its housing-finance sector?

Published by the R Street Institute.

The attached policy brief appeared in the Summer 2016 edition of Housing Finance International, the quarterly journal of the International Union for Housing Finance (IUHF).

It is sobering to Americans that the U.S. housing finance collapsed twice in three decades: in the 1980s and again in the 2000s. This is certainly an embarrassing record.

The giant American housing finance sector, with $10 trillion in mortgage loans, is as important politically as it is financially. Many interest groups want to receive government subsidies through the housing finance system. This makes it very hard to reform.

From the 1980s to today, U.S. housing finance has been unique in the world for its overreliance on the so-called “government-sponsored enterprises,” Fannie Mae and Freddie Mac. Fannie and Freddie get government guarantees for free, which are said to be only “implicit,” but are utterly real. According to Fannie and Freddie in their former days of power and glory, this made American housing finance “the envy of the world.” In fact, the rest of the world did not feel such envy. But Fannie and Freddie did attract investment from the rest of the world, which correctly saw their issues as U.S. government credit with a higher yield. In the 2000s, this channeled the savings of thrifty Chinese and others into helping inflate American house prices into their amazing bubble. Fannie and Freddie became a key point of concentrated systemic vulnerability.

In 2008, Fannie and Freddie went broke. What schadenfreude my German housing finance colleagues enjoyed after years of being lectured on the superiority of the American system! Official bodies in the rest of the world pressured the U.S. Treasury to protect their investments in the obligations of the insolvent Fannie and Freddie, which the Treasury did and continues to do. The Federal Reserve, in the meantime, has become the world’s biggest investor in Fannie and Freddie securities.

Almost eight years after the financial collapse, America is still unique in the world for centering its housing finance sector on Fannie and Freddie, even though they have equity capital that rounds to zero. They are primarily government-owned and entirely government-controlled housing finance operations, completely dependent on the taxpayers. Nobody likes this situation, but it has outlasted numerous reform efforts.

Is there a way out of this statist scheme—can we move American housing finance toward something more like a market? Is there a way to reduce the distortions caused by Fannie and Freddie, to control the hyper-leverage that inflates house prices and the excessive credit that sets up both borrowers and lenders for failure? Can we reduce the chance of repeating the mistakes of 1980 to 2007? Here are some ideas.

Restructure Fannie and Freddie

The original government bailout of Fannie and Freddie created senior preferred stock with a 10 percent dividend, which the U.S. Treasury bought on behalf of the taxpayers. This was later amended to make the dividend be all their net profit. That meant there would never be any reduction of the principal, and the GSEs will be permanent wards of the state.

It is easy, however, to calculate the cash-on-cash internal rate of return (IRR) to the Treasury on its $189.5 billion investment in senior preferred stock, given the dividend payments so far of $245 billion. This represents a return of about 7 percent – positive, but short of the required 10 percent. As Fannie and Freddie keep sending cash to the Treasury, the IRR will rise, and will reach a point when total cash paid is equivalent to a 10 percent compound return, plus repayment of the entire principal. That is what I call the “10 Percent Moment.” It provides a uniquely logical point for reform, and it is not far off, perhaps in early 2018.

At the 10 Percent Moment, whenever it arrives, Congress should declare the senior preferred stock fully repaid and retired, as in financial substance, it will have been. Simultaneously, Congress should formally designate Fannie and Freddie as systemically important financial institutions (SIFIs). They are unquestionably SIFIs – indeed, they are Global SIFIs – able to put not only the entire financial system, but also the finances of the U.S. government at risk. This is beyond the slightest doubt.

As soon as Fannie and Freddie are designated officially – as well as in economic fact – as SIFIs, they will get the same minimum equity capital requirement as bank SIFIs: 5 percent of total assets. At their current size, this would require about $250 billion in equity. They must, of course, be regulated as undercapitalized until they aren’t. Among other things, this means no dividends on any class of stock until the capital requirement is met.

As SIFIs, Fannie and Freddie will and should get the Federal Reserve as their systemic risk regulator, in addition to their housing finance regulator.

It is impossible to take away Fannie and Freddie’s too-big-to-fail status, no matter what any government official says or does. Therefore they should pay the government for its ongoing credit guaranty, on the same basis as banks have to pay for deposit insurance. I recommend a fee of 0.15 percent of total liabilities per year.

Then Fannie and Freddie will be able to compete in mortgage finance on a level basis with other SIFIs, and swim or sink according to their competence.

Promote skin in the game for mortgage originators

A universally recognized lesson from the American housing bubble was the need for more “skin in the game” of credit risk by those involved in mortgage securitization. Lost in the discussion is the optimal point at which to apply credit risk skin in the game. This optimal point is originator of mortgage loans, which should have a junior credit risk position for the life of the loan. The entity making the original mortgage is in the best position to know the most about the borrower and the credit risk of the borrower. It is the most important point at which to align incentives for creating sound credits.

The Mortgage Partnership Finance (MPF) program of the Federal Home Loan Banks was and is based on this principle (I had the pleasure of leading the creation of this program). It finances interest-rate risk in the bond market but keeps the junior credit risk with the original lender. The result was excellent credit performance of the MPF mortgage loans, including through the 2000s crisis.

I believe this credit-risk principle is obvious to most of the world. Why not to the United States?

Create countercyclical LTVs

As the famous investor Benjamin Graham pointed out long ago, price and value are not the same: “Price is what you pay, and value is what you get.” Likewise, in mortgage finance, the price of the house being financed is not the same as its value: in bubbles, prices greatly exceed the sustainable value of houses. Whenever house prices are in a boom, the ratio of the loan to the sound lendable value becomes something much bigger than the ratio of the loan to the inflated current price.

As the price of any asset (including houses) goes rapidly higher and further over its trend line, the riskiness of the future price behavior becomes greater—the probability that the price will fall continues to increase. Just when lenders and borrowers feel most confident because of high collateral “values” (which really are prices), their danger is in fact growing. Just when they are most tempted to lend and borrow more against the price of the asset, they should be lending and borrowing less.

A countercyclical LTV (loan-to-value ratio) regime reduces the maximum loan size relative to current prices, in order to keep the maximum ratio of loan size to underlying lendable value more stable. The boom would thus induce smaller LTVs, and greater down payments, in bubbly markets—thus providing a financial stabilizer and an automatic dampening of price inflation.

Countercyclical capital requirements for financial institutions reduce the leverage of those lending against riskier prices. The same logic applies to reducing the leverage of those who are borrowing against risky prices. We should do both.

Canada provides an interesting example of where countercyclical LTVs have actually been used; Germany uses sustainable lendable value as the same basic idea. The United States needs to import this approach.

Liquidate the Fed’s mortgage portfolio

What is the Federal Reserve doing holding $1.7 trillion of mortgage-backed securities (MBS)? The authors of the Federal Reserve Act and generations of Fed chairmen since would have found that impossible even to imagine. This massive MBS portfolio means the Fed allocates credit to housing through its own balance sheet. Its goal was to push up house prices, as part of its general scheme to create “wealth effects.” It succeeded— house prices have not only risen rapidly, but are back over their trend line on a national average basis. This means, by definition, that the Fed also has made houses less affordable for new buyers.

Why in 2016 is the Fed still holding all these mortgages? For one thing, it doesn’t want to recognize losses when selling its vastly outsized position would drive the market against it. Some economists argue that losses of many times your capital do not matter if you are a fiat currency central bank. Perhaps or perhaps not, but they would be embarrassing and cut off the profits the Fed sends the Treasury to reduce the deficit.

Whatever justification there might have been in the wake of the collapsed housing bubble, the Fed should now get out of the business of manipulating the mortgage-securities market. If it is unwilling to sell, it can simply let its mortgage portfolio run off to zero over time through maturities and prepayments. It should do so, and cease acting as the world’s biggest savings and loan.

The collapses of the 1980s and 2000s should have taught the American government a lesson about the effects of subsidized, overleveraged mortgage markets. It didn’t. The reform of the Fannie and Freddie-centric U.S. housing finance sector has not arrived, nor is there any sign of its approach. But we need to keep working on it.

The Senate needs to pass the House’s Puerto Rico bill

Published by the R Street Institute.

The government of Puerto Rico is broke. It now has multiple defaults on its record, most recently for $367 million in May. More and bigger defaults are on the way, probably beginning July 1. It’s already June 22.

The U.S. Senate should pass the U.S. House’s Puerto Rico bill now.

The House approved the bill by a wide margin, after a long and thorough bipartisan discussions that included sensible compromises and ultimate agreement between the administration and the legislators. The bill gets all the essential points right. These are:

The creation of an emergency financial control board, or “Oversight Board,” to get under control and straighten out the financial management and fiscal balance of the Puerto Rican government.

An orderly and equitable process overseen by the board to address restructuring the government’s unpayable debts.

Beginning a long-term project to move Puerto Rico toward a successful market economy and away from its failed government-centric one.

Of course, any complex set of legislative provisions can give rise to arguments and possibly endless debates about details. That would be a big mistake.

It’s time to enact the bill and get the essentials in place as soon as possible.

R Street and Americans for Tax Reform urge the Senate to pass H.R. 5278 (PROMESA)

Published by the R Street Institute.

June 21, 2016

Dear Senator,

On behalf of the undersigned free market organizations, we urge you to vote “Yes” on the House-passed H.R. 5278, the Puerto Rico Oversight, Management, and Economic Stability Act of 2016 (PROMESA). Puerto Rico faces many challenges, and unfortunately the territory’s fiscal challenges cannot be fixed overnight. However, by putting strong, independent oversight in place, requiring fiscal reforms, and creating a path for addressing financial debt, PROMESA lays the foundation for prudent fiscal management that will lead to future solvency.

The Puerto Rican crisis is the result of many years of fiscal and economic mismanagement, and both the island’s own government and the federal government are complicit. While untangling the web of failed policy will take time, the fact remains: Puerto Rico is broke. The Puerto Rican government is already failing to meet its debt obligations, and with every day that passes, the probability of a crisis increases.

With defaults, combined unfunded pension and debt obligations over $115 billion, and the Puerto Rican government’s failure to produce audited financial statements for several fiscal years, it is imperative to establish financial oversight, get an accurate understanding of the situation, and create an appropriately calibrated fiscal plan to restore growth. The Oversight Board set out in PROMESA is empowered to do exactly this. The Oversight Board will exercise its authority to acquire accurate financial information, establish fiscal plans, create budgets, negotiate with creditors, and ensure enforcement of the deals and plans created under its authority.

While this oversight control is the required first step toward abating Puerto Rico’s crisis, PROMESA also enacts several immediate pro-growth reforms, including altering the island’s unemployment generating minimum wage requirements and overtime regulations, and putting a plan in place for infrastructure improvements. These changes are an important part of altering the island’s path, and we urge the congressional task force created by the bill to search for further opportunities to reform policies currently limiting Puerto Rico’s growth and promote a market economy.

PROMESA lays out a process to ensure the island’s creditors are treated justly during any future debt restructuring. It encourages voluntary restructuring, requires the Oversight Board to ‘respect the relative lawful priorities’ of the various debt classes, and distinguishes between debt obligations and pensions.

We applaud the House for its leadership on this issue. The bill has been strengthened, and currently represents Puerto Rico’s best chance to return solid fiscal footing. It is now the Senate’s turn. By voting for passage, Senators will fulfill their obligation under the Constitution to ‘make all the needful rules’ regarding the territories. We urge you therefore to vote yes.

Sincerely,

R Street Institute

Americans for Tax Reform

The PBGC: A broke insurance company sponsored by your government

Published in Real Clear Markets.

Imagine an insurance company with assets of $88 billion, but liabilities of $164 billion. It has a huge deficit: a net worth of a negative $76 billion, and a capital-to-asset ratio of minus 87 percent.

Would any insurance commissioner anywhere allow it to remain open and to keep taking premiums from the public to “insure” losses it manifestly cannot pay? Of course not. Would any rational customer buy an insurance policy from it, when the company cannot even hope to honor its commitments? Nope.

But there is such an insurance company, open and in business and taking in new premiums for obligations it will not be able to pay. Needless to say, it is a government insurance company, since no private entity could continue in business in such pathetic financial shape. It is the Pension Benefit Guaranty Corp. (PBGC), a corporation wholly owned by the U.S. government, operating on an obviously failed model. Its board of directors comprises the secretaries of the departments of Labor, Commerce and the Treasury; quite a distinguished board for such egregious results.

There are two financially separate parts of the PBGC: the Single-Employer Program, which insures the defined-benefit pension plans of individual companies; and the Multiemployer Program, which insures union-sponsored plans with multiple companies making pension contributions. The Single-Employer Program has a large deficit, with assets of $86 billion, liabilities of $110 billion and a negative net worth of $24 billion. That is bad enough.

But now imagine an insurance company with assets of $2 billion and liabilities of $54 billion. That is a truly remarkable relationship. Its net worth is negative $52 billion, or 26 times its assets. That is the PBGC’s Multiemployer Program – which, as no one can doubt, is well on the way to hitting the wall.

The PBGC can continue to exist for only two reasons: because the government forces pension plans to buy insurance from it and because its political supporters entertain the abiding hope that Congress will somehow or another give it a lot of other people’s money to cover its unpayable obligations.

Congress should not do this, and so far, it has shown no inclination to announce a taxpayer bailout. But the real simultaneous financial and political crunch will occur when the disastrous Multiemployer Program runs out of cash while still being oversupplied with obligations. This moment is readily foreseeable, but has not yet arrived and is estimated to be a number of years off.

The PBGC was created by the Employment Retirement Income Security Act of 1974 (ERISA). This put into statue an idea created by the research department of the United Auto Workers union in 1961: let’s get the government to guarantee our pensions. The idea was politically brilliant but, financially, less brilliant.

According to the law, the PBGC was not supposed to be able to get itself into the insolvent status in which it not finds itself. As each PBGC Annual Report always informs us, “ERISA requires that PBGC programs be self-financing.” But they aren’t—not by a long shot, where the value of that long shot is at least $76 billion. What does the “requirement by law” to be self-financing mean when you aren’t and have no hopes to be so?

One thing originally intended to be quite clear we find in the next Annual Report sentence: “ERISA provides that the U.S. Government is not liable for any obligation or liability incurred by PBGC.” To repeat: Not liable. But of course, they said the same thing in statute about Fannie Mae and Freddie Mac. They made Fannie and Freddie put that in bold face type on every memorandum offering their debt for sale. But they bailed out Fannie and Freddie anyway.

As it has turned out, the Fannie and Freddie bailout has proved to provide a positive investment return to the taxpayers: an internal rate of return of about 7 percent so far. But any bailout money put into the PBGC will be simply gone. It would not be an investment, but purely a transfer payment.

That reflects the fact that Fannie and Freddie, when their operations were not perverted by politically mandated excess risk, had a fundamental model capable of making profits, as they did before the housing bubble and now are again. This profit potential is not shared by the PBGC. Its fundamental model is to take politically mandated excess risk in order to promote unaffordable pensions, not to insure them according to rational actuarial principles.

Defined-benefit pension plans have proved beyond doubt to be an extremely risky financial construction. The idea that the government is guaranteeing them encouraged the negotiation of pensions unaffordable to the sponsors in the first place, and the underfunding of pension obligations later. These are the kinds of very costly moral hazards entailed in the very existence of the PBGC. Of course, the PBGC might have, had Congress allowed it to, charged vastly higher premiums. But this would be against the other of its assigned missions: to encourage and promote defined-benefit pensions.

You can understand how this was felt to be a nice idea, but it creates an irresolvable conflict for the PBGC. The corporation is simultaneously supposed to promote the use and survival of defined-benefit pension programs, while it is also supposed to run a sound, self-financing insurance company. Obviously, it has utterly failed at being a sound insurer. Arguably, by creating incentives to design unaffordable pensions, it also failed at promoting defined-benefit pension plans, and has rather accelerated their ongoing demise.

There is no easy answer to the PBGC problem as a whole, but Congress took a sensible and meaningful step with the Kline-Miller Multiemployer Pension Reform Act of 2014. We will devote the next essay to examining the implications of this act and the reasonable attempt to use it recently thwarted by the U.S. Treasury Department.

Does the Federal Reserve know what it’s doing?

Published by the R Street Institute.

The attached policy study was published in Cato Journal, Vol. 36, No. 2.

The Federal Reserve is the most financially dangerous institution in the world. It represents tremendous systemic risk—more systemic financial and economic risk than anybody else. Fed actions designed to manipulate the world’s dominant fiat currency, based on the debatable theories and guesses of a committee of economists, can create runaway consumer price and asset inflation, force negative real returns on people’s savings, reduce real wages, stoke disastrous financial bubbles that lead to financial collapses, distort markets and resource allocation, and in general create financial instability. The Fed has done or is doing all of these things—ironically enough—in the name of pursuing stability. But whatever its intentions, does the Fed actually know what it is doing? Clearly, it hasn’t in the past, and it is exceptionally dubious in principle that it ever can. Since that is true, how can anybody think the Fed should be an independent power?

How high are real house prices?

Published in Real Clear Markets.

“Home prices are back to near-record highs across the U.S.” declared the Wall Street Journal in a June 1 front-page story. They are, indeed, when measured in nominal terms.

The Case-Shiller National House Price Index for the first quarter of 2016 is as high as it was in September 2005, in the late-phase frenzy of the bubble. That was only nine months before the 2006 bubble-market top, which as we know only too well, was followed by collapse. In addition to reaching its 2005 level, the National House Price Index has gone back to well over its trend line—more than 11 percent over. All this is shown in Graph 1.

So the Federal Reserve has gotten its wish for re-inflated house prices (although not its wish for robust economic growth).

Are high house prices good or bad? That depends on whether you are selling or buying. If you are the Fed, it depends on how much you believe that creating asset-price inflation leads to “wealth effects” that improve economic growth.

Of course, besides asset-price inflation, the Fed truly believes in regular old inflation. It has often announced its intent to create perpetual increases in consumer prices. Since the bubble top in 2006, the Consumer Price Index has increased by an aggregate of 17 percent.

This means that house prices – measured in real, inflation-adjusted terms – look different from Graph 1. Real house prices are shown in Graph 2, expressed in constant 2000 dollars. They have still gone up a lot in the last few years, but not as much as in nominal terms. They have matched their level from October 2003, rather than September 2005.

In October 2003, house prices were clearly inflating: they were half way, but only half way, up their memorable bubble run from 1999 to 2006. Do we remember how happy so many people were with those high house prices? Do we remember that the Fed Funds Rate had then been reduced to 1 percent? That the Fed was thinking of wealth effects? At the time (in January 2004), the Wall Street Journal published an article entitled, “Housing Prices Continue to Rise.” It reported that “the decline in interest rates has made housing more affordable,” that forecasts were for “the house party to rage on in 2004”—a good forecast— and that “few housing pundits see much risk of a national plunge in house prices”—a terrible forecast.

In 2003, was it time to pay attention? It was. Going forward from here, can we imagine what house prices would be with genuinely normalized interest rates? In mid-2016, can the pundits see much risk of anything going wrong?

Power, independence and guessing

Published in Library Of Law & Liberty.

The Power and Independence of the Federal Reserve is an informative and provocative history of the Fed and its remarkable evolution over a hundred years’ time: a complex institution, in a complex and changing environment.

Very importantly, author Peter Conti-Brown has included the Fed’s intellectual evolution, or the shifting of the ideas that shape its actions as these ideas go in and out of central banking fashion. This account makes readers wonder what new ideas and theories the leaders of the Fed will adopt, reinforce by groupthink with their fellow central bankers, and try out on us in future years.

As for the power wielded by the Fed, it has obviously come a very long way since its beginnings, when it was, as Conti-Brown describes it, “an obscure backwater government agency.” That is hard for today’s Americans to imagine. To illustrate the change, Conti-Brown relates the memorable story of when the new Federal Reserve Board went to President Wilson’s Secretary of the Treasury, William McAdoo, to complain that at a state function the board members were not given sufficient prominence in order of seating. McAdoo took the problem to Wilson. “Well, they might come right after the fire department,” replied the irritated President.

Little could he know that the Fed would become, in time, the global financial fire department, as part of being central bank to a world in which its fiat dollars were the dominant currency.

Of course the Fed has made, and doubtless will continue to make, great mistakes. Its enormous power, combined with its unavoidable human fallibility, renders it without question the most dangerous financial institution in the world—far and away the greatest potential creator of systemic financial risk there is.

Put that together with the other idea in Conti-Brown’s title: independence. He considers many factors affecting the independence the Fed so much wants and so energetically defends. He rightly emphasizes something as crucial as it is little-discussed: the Fed’s budgetary independence. The Fed, as Conti-Brown points out, is entirely free from the “power of the purse” normally exercised by Congress. Instead, it is able to spend whatever it wants out of the very large profits it automatically makes by issuing money, both the printed and the bookkeeping varieties. On the money-issuing and the spending, there is no constraint except its own decisions.

The more independent the Fed is, combined with its power and the huge riskiness of its actions, the bigger an institutional puzzle it represents in a government that was built on the principle of checks and balances.

In the famous conclusion of The General Theory of Employment, Interest, and Money (1936), John Maynard Keynes tells us that “soon or late, it is ideas . . . which are dangerous for good or evil.” This is true in general in human affairs, but it is especially true of the ideas that come, from time to time, to dominate the minds of central bankers—and most importantly, the central bankers who run the Fed. Conti-Brown’s tracing of the ideas of the Fed’s dominant personalities over time is key to understanding the institution.

For example, take the idea of fiat money. This was clearly not what the Fed would be about, in the minds of the authors of the Federal Reserve Act, like then-Chairman of the House Banking Committee, Carter Glass (D-Va.). Conti-Brown writes: “The claim that the new Federal Reserve Notes would represent ‘fiat money’ were fighting words.” He quotes Glass’s defense on the floor of the House of Representatives against the charge: “Fiat money! Why, sir, never since the world began was there such a perversion of terms.” But now the Fed is known by all to be the center and font of the worldwide fiat money system.

Or take inflation. Conti-Brown nicely summarizes the view of William McChesney Martin, Chairman of the Fed for 19 years and under five U.S. Presidents in the 1950s and 1960s: “The keeper of the currency is the one who has to enforce the commitment not to steal money through inflation.” But now the Fed has decided to commit itself to perpetual inflation and has for seven years been stealing money from savers through negative real interest rates—all for the greater good as embodied in its current theories and beliefs.

As Conti-Brown says, it is not the case that there are “objectively correct answers to problems of monetary policy . . . in a democracy.” That is why the Money Question, as impassioned historical debates called it, is always political and not merely technical. Central banking is, he writes, “plagued by uncertainty, model failures, imperfect data, and even central banker ideology.” (He should have left out that “even.”)

Conti-Brown views central bankers as “adjudicating between conflicting views of that uncertainty, those failures, these ideologies.” Quite right, except that he has a more optimistic view of the process than I do. In place of “adjudicating” among uncertainties, a more accurate term would be “guessing.”

This recalls a marvelous letter to the Financial Times of several years ago suggesting that “in mathematics, one answer is right; in literature, all answers are right; and in economics, no answers are right.” Conti-Brown says “it is tempting to throw out the entire enterprise of central banking as politics by another name.” But as he also says, this would not be right, either.

The key fact is that in central banking the uncertainty is high and, therefore, guessing is required. But the cost of mistakes can be enormous. This causes responsible minds to tend to cluster around common ideas and to reinforce each other by saying the same things. The book discusses this clustering in terms of “cognitive capture,” but I think a better description would be “cognitive herding.” This affects central bankers as it does everybody else when confronted with the need to decide and act in the face of ineluctable uncertainty.

In making decisions subject to uncertainty, metaphors are helpful, and Conti-Brown is fond of what he calls “the poetry of central banking”—that is, powerful figures of speech. The most famous such metaphor is that of Chairman Martin, who characterized the Fed as the “chaperone who has ordered the punch bowl removed just when the party was really warming up.” Martin (who studied English and Latin at Yale) “changed the language of central banking,” says Conti-Brown, and therefore its ideas. One can only imagine how surprised Martin would be that, in recent years, the chaperone has been the one pouring bottles of rum into the punch bowl to liven up the party.

Finally, on the subject of the Fed’s independence, Conti-Brown quotes Fed Chairman Ben Bernanke telling his successor, Janet Yellen, that “Congress is our boss.” But does the Fed as an institution really accept that as it insistently defends and pursues its independence? The more the Fed achieves practical independence from Congress, the more intriguingly alien to our fundamental Constitutional order it is.

Time for Congress to vote in the new Puerto Rico bill

Published by the R Street Institute.

A revised bill to address the intertwined debt, fiscal and economic crises of Puerto Rico has just been introduced in the U.S. House. H.R. 5278 proposes “to establish an Oversight Board, to assist the Government of Puerto Rico…in managing its public finances.”

This “assistance” (read, “supervision”) is needed intensely. If all goes well, the House Natural Resources Committee will report the bill out promptly and it will proceed to enactment.

As is well-known, the government of Puerto Rico is broke and defaulting on its debt. At $118 billion, by the committee’s reckoning (which rightly includes unfunded government pensions), that debt is six times the total debt and unfunded pensions of the City of Detroit as it entered bankruptcy. This is a truly big insolvency, which reflects long years of constant fiscal deficits filled in by excess borrowing. Moreover, as the committee points out, Puerto Rico’s “state-run economy is hopelessly inefficient.”

There are three fundamental tasks involved in the complex and massive problems, and the bill addresses all three. These are:

To establish an emergency financial control board to determine the extent of the insolvency, develop fiscal and operational reforms and put the government of Puerto Rico on a sound financial basis. The bill uses the more politic title of “Oversight Board,” but the tasks are the same. They will not be easy and are sure to be contentious, but are necessary.

To restructure the unpayable debt and settle how the inevitable losses to creditors are shared among the parties. The bill gives the Oversight Board the authority, if necessary, to put forth a plan of debt reorganization and the legal framework to reach settlement.

To move Puerto Rico toward economic success – that, is toward a market economy and away from its failed government-centric economy – and thus to give it the potential for future growth. These reforms will not be easy, either, but the bill sets out a process to start the required evolution.

The discussion of the necessary steps has been long and full. Now it’s time for Congress to vote in the new bill.

Puerto Rico: A big default—what next?

Published in the Library Of Law And Liberty.

Rexford Tugwell, sometimes known as “Rex the Red” for his admiration of the 1930s Soviet Union and his fervent belief in central planning, was made governor of Puerto Rico by President Franklin Roosevelt in 1941. Among the results of his theories was the Government Development Bank of Puerto Rico, a bank designed as “an arm of the state,” which is a central element in the complicated inner workings of the Puerto Rican government’s massive insolvency.

The bank has just defaulted on $367 million of bonds – the first, but unless there is congressional action, not the last, massive default by the Puerto Rican government and its agencies on their debt. The Government Development Bank was judged insolvent in an examination last year, but the finding was kept secret. The governor of Puerto Rico has declared a “moratorium” on the bank’s debt, which means a default. A broke New York City in 1975 also defaulted and called it a “moratorium.”

Adding together the Puerto Rican government’s explicit debt of about $71 billion and its unfunded pension liabilities of about $44 billion amounts to $115 billion. This is six times the $18 billion in bonds and pension debt of the City of Detroit, which holds the high honor of being the largest municipal bankruptcy ever.

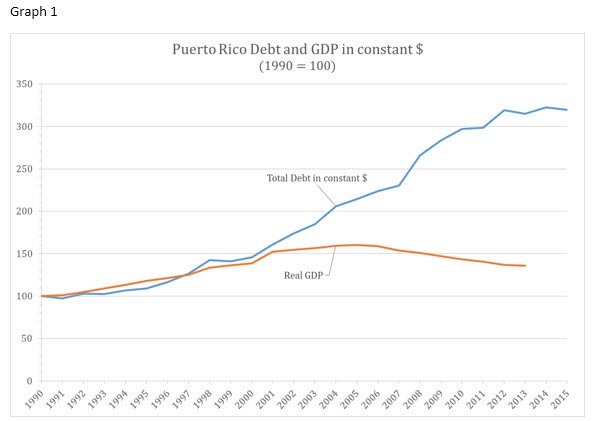

Puerto Rico’s government-centric political economy goes back to Rex the Red, but its budget problems are also long-standing. In this century, the government has run a deficit every year, borrowed to pay current expenses, and then borrowed more to service previous debt until the lenders belatedly ceased lending and the music stopped. Its debt and its real gross domestic product definitively parted company in 2001 and have grown continuously further apart, as shown Graph 1.

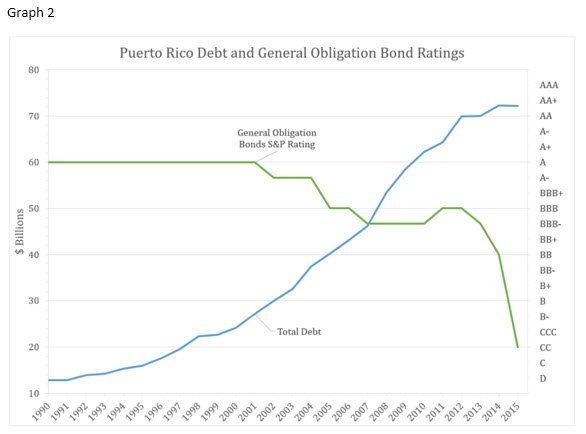

As its debt skyrocketed, the credit ratings of its bonds fell and then crashed. See Graph 2.

Where do we go from here? Addressing the deep, complicated, and contentious problems requires three steps:

The creation of an emergency financial control board to assume oversight and control of the financial operations of the government of Puerto Rico, which has displayed incompetence in fiscal management (or mismanagement), is a central aspect of the solution. This control board can be modeled on those successfully employed to address the insolvencies and financial mismanagement in the District of Columbia in the 1990s, in New York City in the 1970s and in numerous other places. More recently, the City of Detroit got an emergency manager along the same lines.

Such a board would be and must be quite powerful. The sine qua non for financial reform is to establish independent, credible authority over all books and records; to determine the true extent of the insolvency of the many indebted government entities—in particular to get on top of the real condition of the Government Development Bank; and to develop fiscal, accounting, control and structural reforms which will lead to future balanced budgets and control of the level of debt.